Refining ETF Asset Momentum Technique

Right now’s analysis introduces a refined ETF asset momentum technique by combining a correlation filter with selective shorting. Whereas conventional long-short momentum methods often yield suboptimal outcomes, the lengthy leg proves efficient by itself, and the correlation filter demonstrates important worth for enhancing the timing and efficiency of the quick leg. We suggest a remaining technique of going lengthy on 4 top-performing ETFs whereas selectively shorting 1 ETF with a 30% weight. Our findings reveal that this mixed long-short selective hedge technique considerably outperforms standalone momentum methods and the benchmark, delivering superior risk-adjusted returns and efficient hedging throughout unfavorable market circumstances.

Introduction

Momentum is undoubtedly one of the vital well known market anomalies. It operates on the premise that winners are likely to proceed outperforming whereas losers underperform. Nevertheless, its returns have declined in latest a long time, significantly in homogeneous markets with excessive asset correlations. As proven in “Robustness Testing of Nation and Asset ETF Momentum Methods” extremely correlated nation ETFs fail to ship important alpha. Conversely, the variety and low correlation of asset ETFs current a extra favorable setting for momentum methods.

Impressed by these findings, we wished to discover strategies to deal with the declining efficiency of momentum methods in homogeneous markets, significantly commodity ETFs. We sought to reply the query “Easy methods to Enhance Commodity Momentum Utilizing Intra-Market Correlation”. We calculated the ratio between 20-day and 250-day correlation and investigated its use in figuring out intervals when momentum methods are more likely to succeed. The findings reveal that when the short-term correlation exceeds the long-term correlation, a momentum technique—going lengthy on top-performing ETFs and quick on underperformers—yields optimum outcomes. Conversely, when the short-term correlation is decrease, a reversal technique is simpler.

Equally, “Easy methods to Enhance ETF Sector Momentum” highlighted the potential of mixing long-only momentum with selective shorting. Though the long-short ETF sector momentum technique by itself doesn’t carry out nicely, the right unbiased settings of lengthy and quick legs can yield environment friendly outcomes. By decreasing the quick leg’s weight to five%-30% and making use of it solely throughout adverse market tendencies, the technique achieved considerably improved efficiency.

The primary aim of this text is to construct upon the aforementioned concepts to reinforce ETF asset momentum methods. We suggest combining momentum with a correlation filter to selectively hedge utilizing quick positions when acceptable. First we take a look at a easy momentum technique. Subsequent, we develop the correlation filter as a predictor. We then discover what number of belongings needs to be purchased and bought and concentrate on discovering the candy spot—the right stability between lengthy and quick positions and their weights. The novelty of our paper lies in creating a better manner to make use of momentum methods: combining concepts like selective shorting and correlation tendencies to make the technique work higher and cut back dangers.

Information & Methodology

Our evaluation relies on the adjusted shut costs of 13 ETFs, obtained from Yahoo Finance. Adjusted shut costs had been chosen as they account for dividends, inventory splits, and different occasions influencing ETF worth. The dataset spans from April 10, 2006, to February 28, 2023. Our funding universe consists of 13 ETFs representing varied asset lessons. These embody 6 inventory ETFs, 3 bond ETFs, 3 commodity ETFs, and 1 foreign money ETF.

For inventory ETFs we selected SPDR S&P 500 ETF Belief (SPY), iShares Russell 2000 ETF (IWM), iShares MSCI EAFE ETF (EFA), iShares MSCI Rising Markets ETF (EEM), iShares U.S. Actual Property ETF (IYR), Invesco QQQ Belief (QQQ). For bond ETFs we selected iShares iBoxx $ Funding Grade Company Bond ETF (LQD), iShares 7-10 12 months Treasury Bond ETF (IEF), iShares TIPS Bond ETF (TIP). For commodity ETFs we selected SPDR Gold Shares (GLD), United States Oil Fund, LP (USO), Invesco DB Commodity Index Monitoring Fund (DBC). Lastly we included Invesco CurrencyShares Euro Forex Belief (FXE) because the foreign money ETF.

The benchmark for our evaluation is an equally weighted portfolio of the 13 chosen ETFs.

The evaluation is split into 4 predominant steps.

First, the Easy Momentum Technique. Utilizing value knowledge, we calculate the 1- to 12-month momentum for every ETF every month and rank them based mostly on their efficiency. This rating offers the indicators for which ETFs to go lengthy and which to quick. We take a look at this technique with equal weights throughout the portfolio, rebalancing month-to-month, and accounting for shorting prices.

Second, the Correlation Filter. We calculate short-term (20-day) and long-term (250-day) correlations amongst ETFs. The ratio of those correlations serves as a filter to determine favorable circumstances for momentum methods. If short-term correlation exceeds long-term correlation, a momentum technique is utilized. If short-term correlation is decrease, no place is entered.

Third, the Optimum Variety of Belongings. We discover the best variety of ETFs to incorporate within the portfolio for each lengthy and quick legs throughout a set interval (utilizing a median of the three, 6, 9, and 12-month momentum intervals).

Lastly, the Optimum Weighting Scheme. We hypothesize {that a} quick leg with decreased weight can successfully hedge the lengthy leg with out extreme danger. We take a look at varied weight schemes to find out probably the most appropriate one.

Outcomes

Asset Momentum

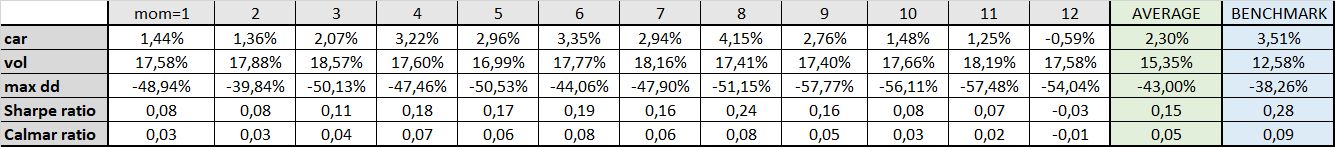

Step one in our evaluation was to check a easy momentum technique. We discover that regardless of variation in rating interval and the variety of belongings, the long-short momentum technique’s efficiency is dissatisfying usually. Determine 1 illustrates the cumulative efficiency of the easy momentum technique in addition to benchmark, whereas Desk 1 offers common efficiency metrics for portfolios with 4 ETFs held lengthy and 4 ETFs held quick. The long-short momentum technique underperformed the benchmark throughout all rating intervals, as evidenced by decrease Sharpe and Calmar ratios in Desk 1. Decrease efficiency and better volatility in comparison with benchmark spotlight the necessity for refinement of this technique.

Determine 1 long-short easy momentum technique

Desk 1 long-short easy momentum technique traits

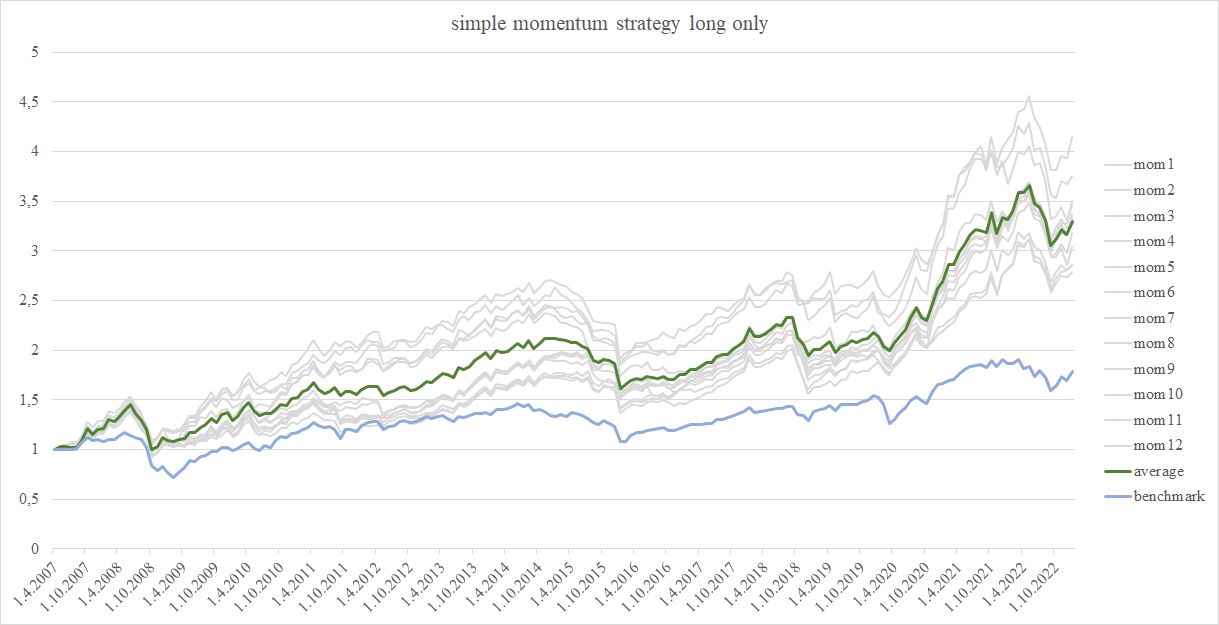

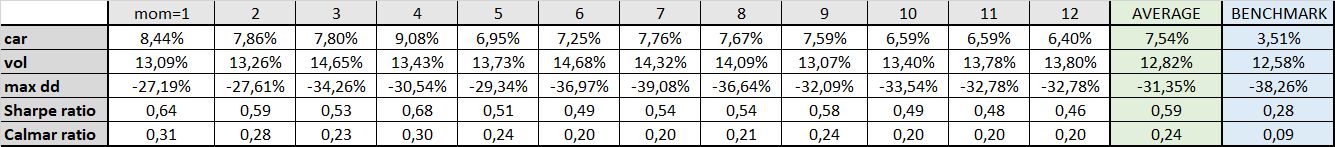

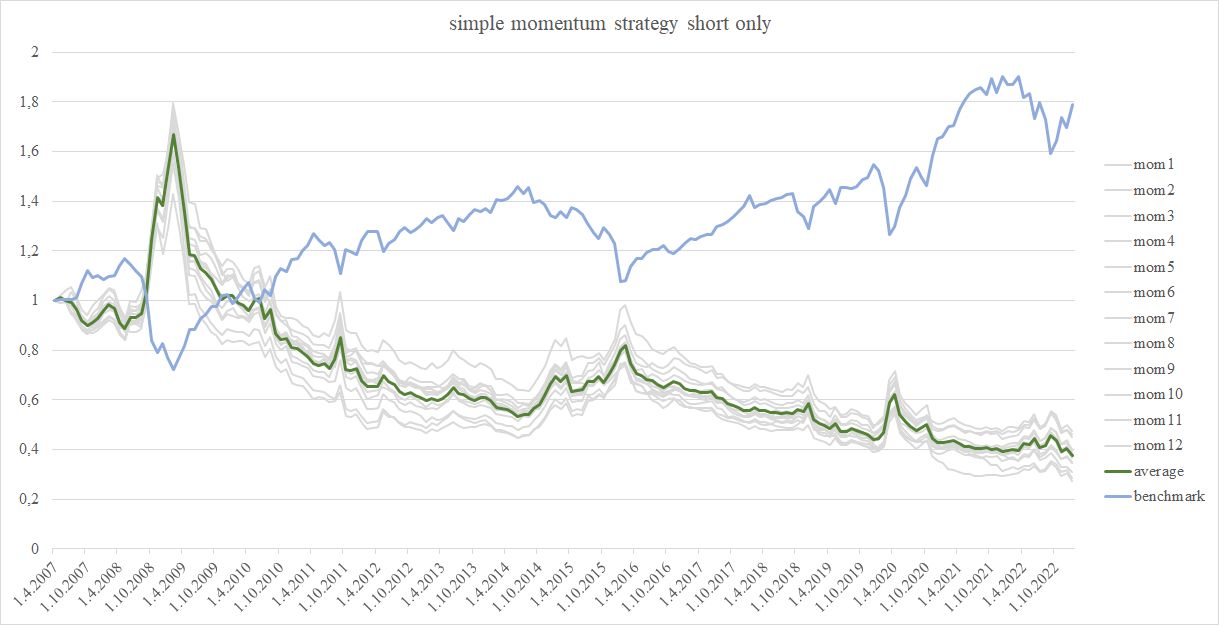

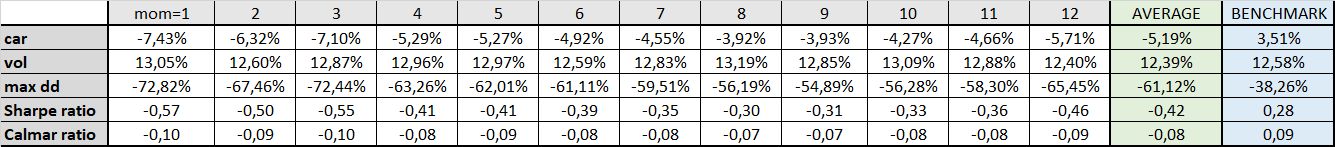

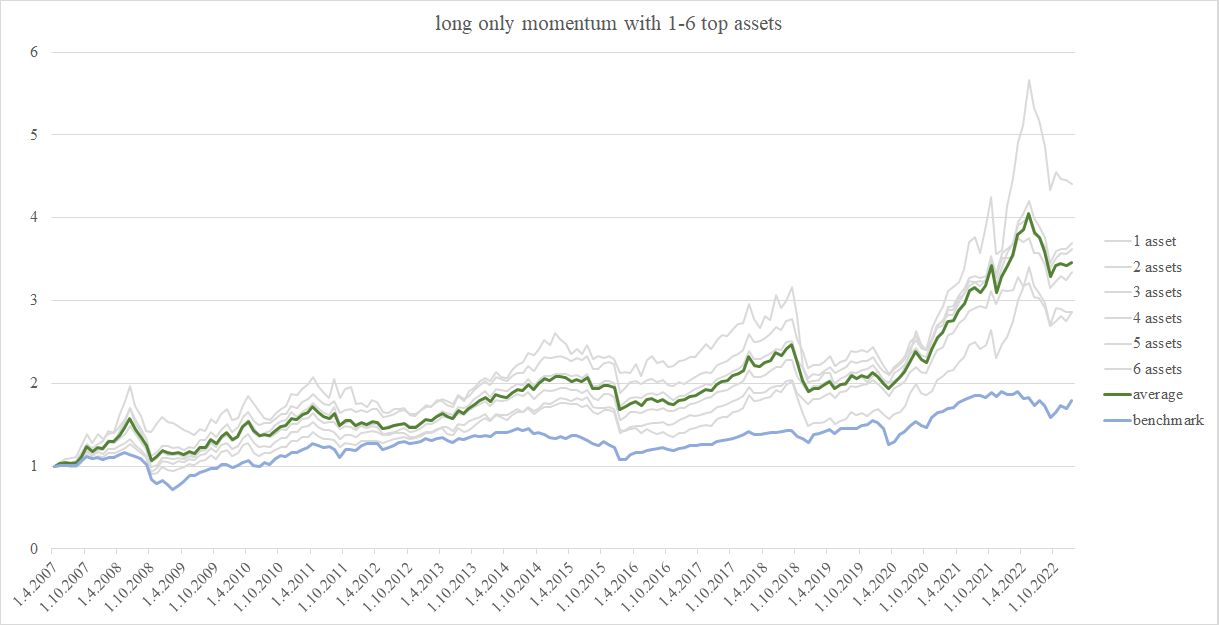

For deeper understanding of underlying dynamics, we determined to take a look at efficiency over 1-12 month interval for lengthy leg and quick leg individually. As proven in Determine 2 and Desk 2, the lengthy leg persistently outperformed the benchmark, whatever the rating interval. In distinction, Determine 3 and Desk 3 reveal that the quick leg persistently underperformed the benchmark. This means that decreasing weight of the quick positions can enhance the technique’s general efficiency as demonstrated within the literature.

Determine 2 long-only momentum

Desk 2 long-only momentum traits

Determine 3 short-only momentum

Desk 3 short-only momentum traits

Correlation Filter

As in our earlier articles, we used the correlation filter as a predictor to determine when it’s favorable to use a momentum technique. The primary concept is that if the common short-term (20-day) correlation exceeds the common long-term (250-day) correlation, it signifies that ETFs are trending in a single course, making momentum methods simpler in distinguishing between winners and losers. This evaluation was carried out individually for the lengthy leg and quick leg.

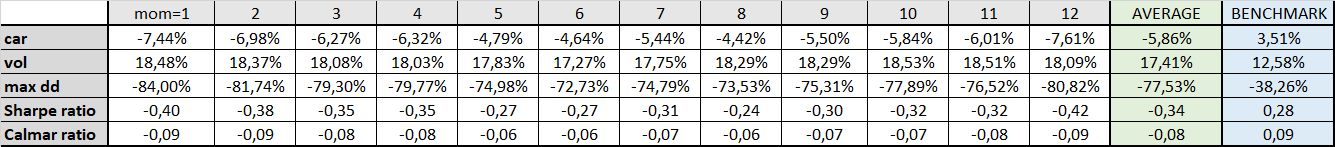

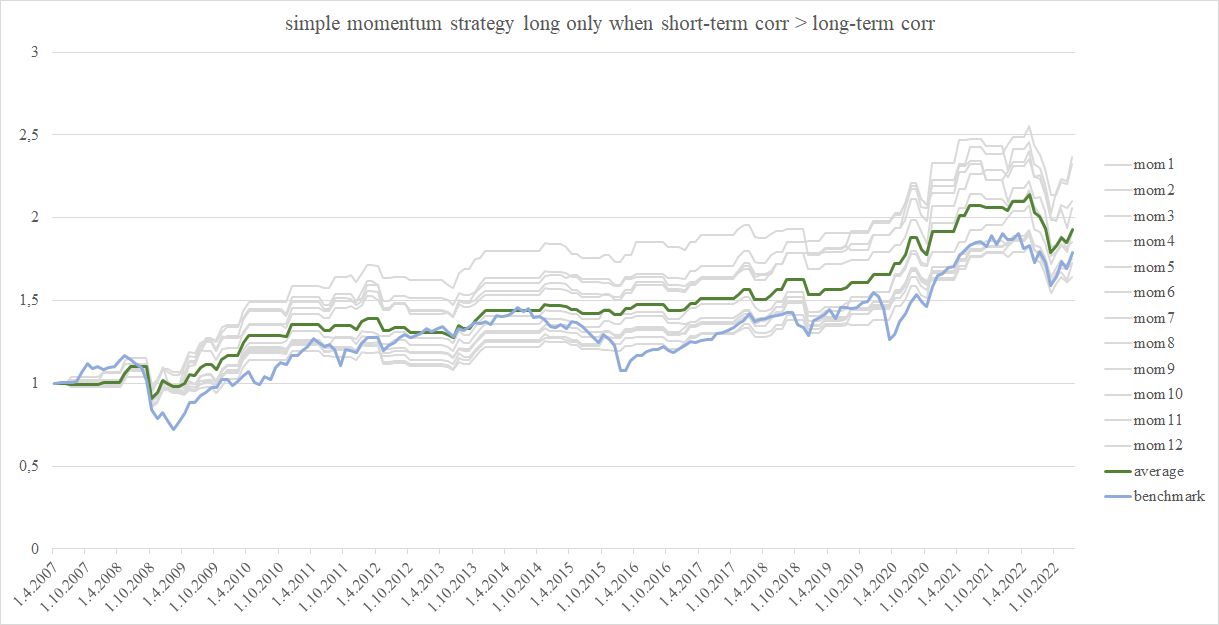

We first utilized the correlation filter to the lengthy leg, analyzing conditions the place short-term correlation exceeds long-term correlation and the place short-term correlation is decrease than long-term correlation. When short-term correlation exceeds long-term correlation, the lengthy leg’s efficiency improves in comparison with the benchmark, as mirrored in greater Sharpe and Calmar ratios (see Determine 4 and Desk 4). Even when short-term correlation is decrease than long-term correlation, the lengthy leg’s efficiency stays acceptable, as proven in Determine 5 and Desk 5.

We conclude that the correlation filter has a restricted impression on the lengthy leg. Momentum alone is adequate to drive returns for the top-performing ETFs, and the filter doesn’t considerably improve or diminish outcomes on this case.

Determine 4 long-only momentum when short-term correlation exceeds long-term correlation

Desk 4 long-only momentum when short-term correlation exceeds long-term correlation traits

Determine 5 long-only momentum when short-term correlation is decrease than long-term correlation

Desk 5 long-only momentum when short-term correlation is decrease than long-term correlation traits

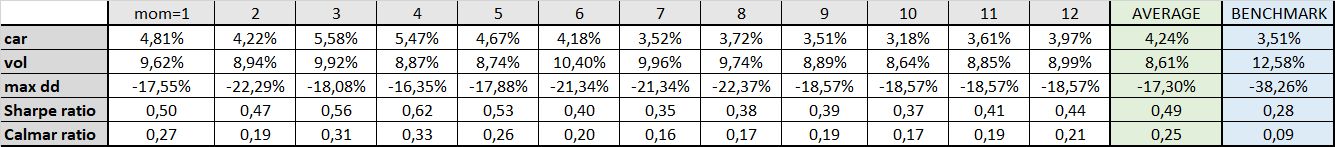

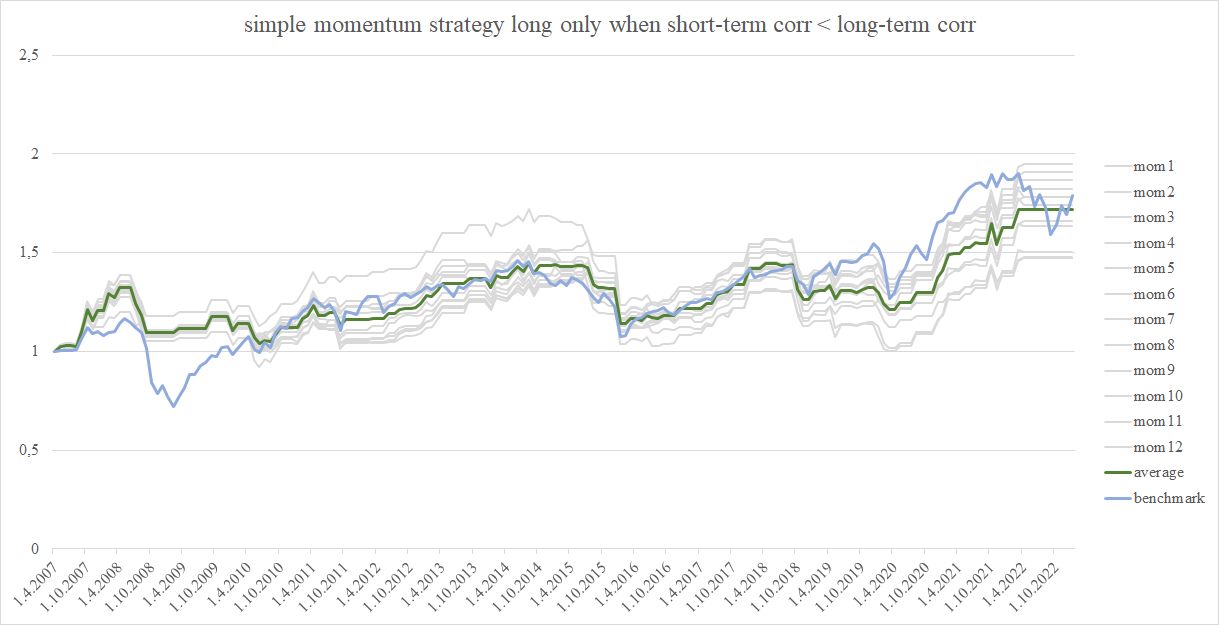

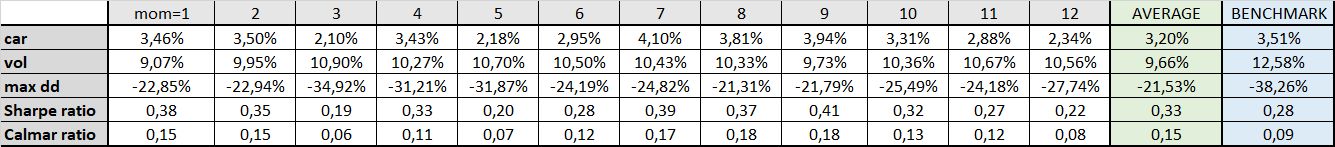

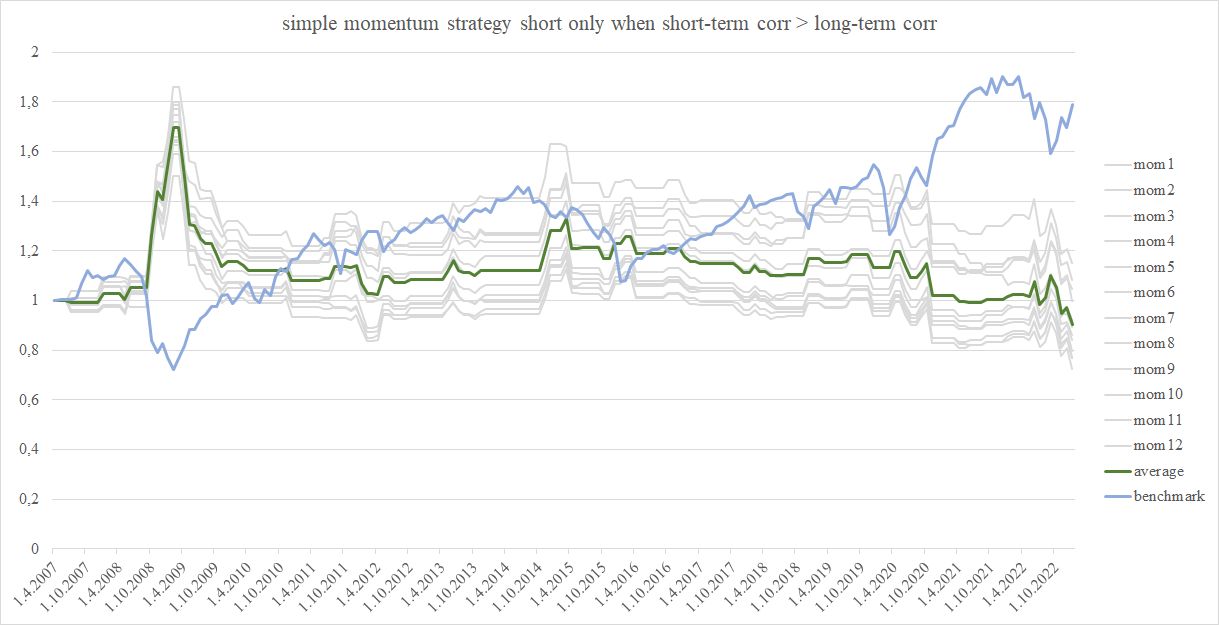

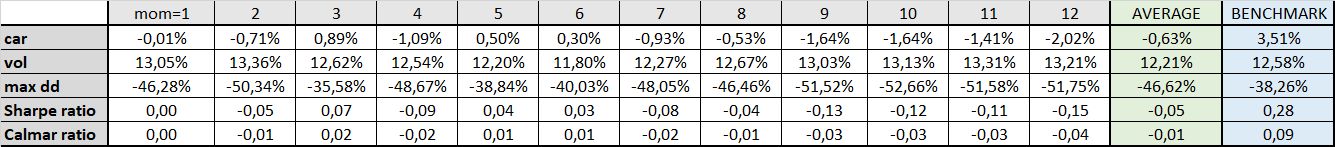

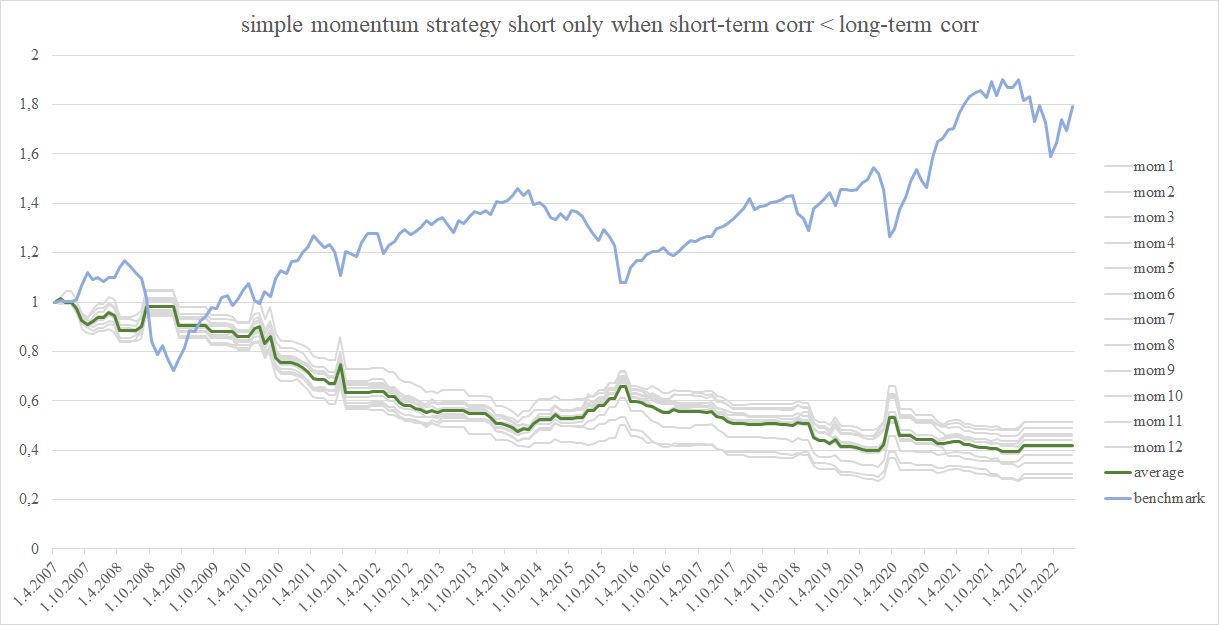

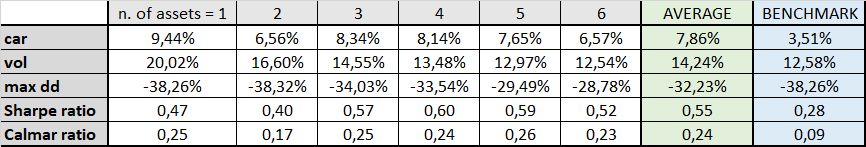

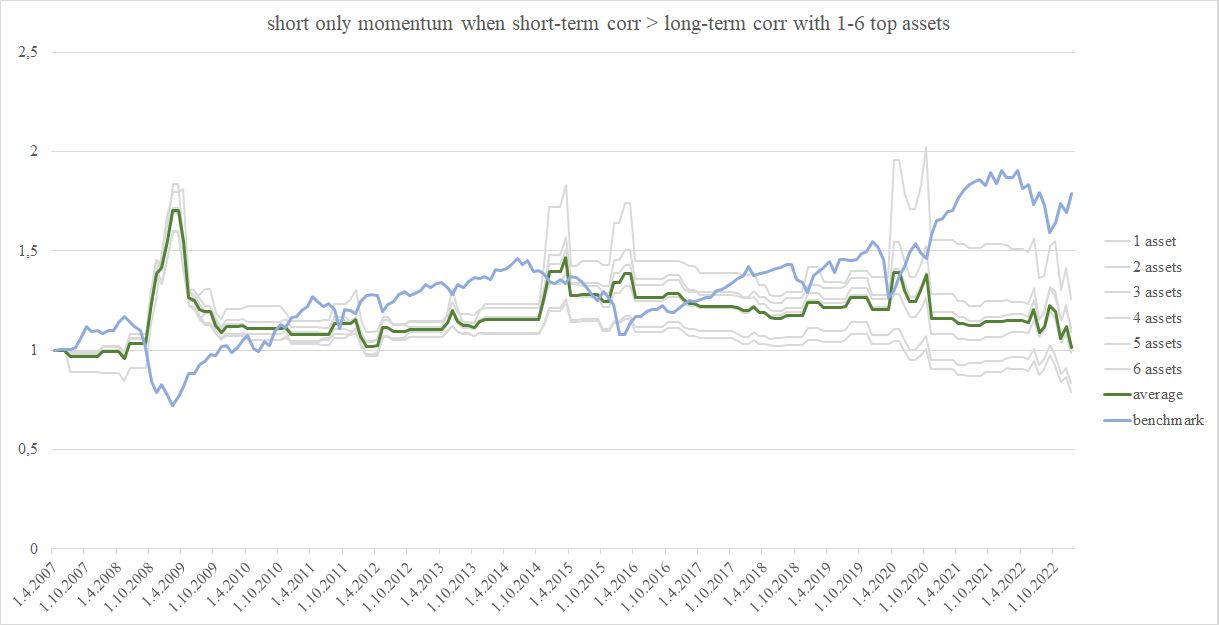

We then utilized the correlation filter to the quick leg to determine intervals when quick positions can be simpler. The filter appears to reliably separate intervals of sturdy underperformance (determine 7, desk 7) and never so abysmal efficiency (Determine 6, Tables 6). This characteristic makes a correlation filter helpful for selective hedging by selecting the correct moments to open low cost quick positions (because the inexperienced line in Determine 6 suggests).

Determine 6 short-only momentum when short-term correlation exceeds long-term correlation

Desk 6 short-only momentum when short-term correlation exceeds long-term correlation traits

Determine 7 short-only momentum when short-term correlation is decrease than long-term correlation

Desk 7 short-only momentum when short-term correlation is decrease than long-term correlation traits

The correlation filter + momentum are most helpful for enhancing the timing and choice of quick positions. This makes it efficient to make use of for selective hedging because it helps to keep away from shorting throughout unfavorable circumstances and capitalizing on favorable ones. Momentum alone is the important thing driver for the lengthy leg, requiring minimal filtering.

The earlier analyses examined 1-12 month rating intervals, however we sought to slender down the momentum timeframes. For the subsequent levels, we determined to make use of the trade normal and common efficiency throughout 4 particular timeframes: 3, 6, 9, and 12 months.

Variety of belongings in mounted interval

This a part of the evaluation focuses on figuring out the optimum variety of ETFs to incorporate within the portfolio for each lengthy and quick legs.

First, we examined portfolios with 1 to six ETFs within the lengthy leg, utilizing the common efficiency over 3, 6, 9, and 12-month momentum intervals. The outcomes present that portfolios with 3 to six ETFs present probably the most steady efficiency, as seen in Determine 8 and Desk 8. We imagine that holding 4 belongings (the highest tercile of the funding universe) is perfect.

Determine 8 long-only momentum with various variety of belongings

Desk 8 long-only momentum with various variety of belongings traits

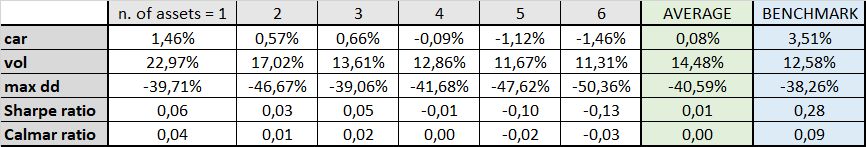

For the quick leg, we adopted the identical course of and located that the efficiency of the quick leg is finest when it consists of fewer (1-3) ETFs, as proven in Determine 9 and Desk 9. We contemplate shorting a single ETF to be optimum.

Determine 9 short-only momentum when short-term correlation exceeds long-term correlation with various variety of belongings

Desk 9 short-only momentum when short-term correlation exceeds long-term correlation with various variety of belongings traits

Lengthy-short selective hedge

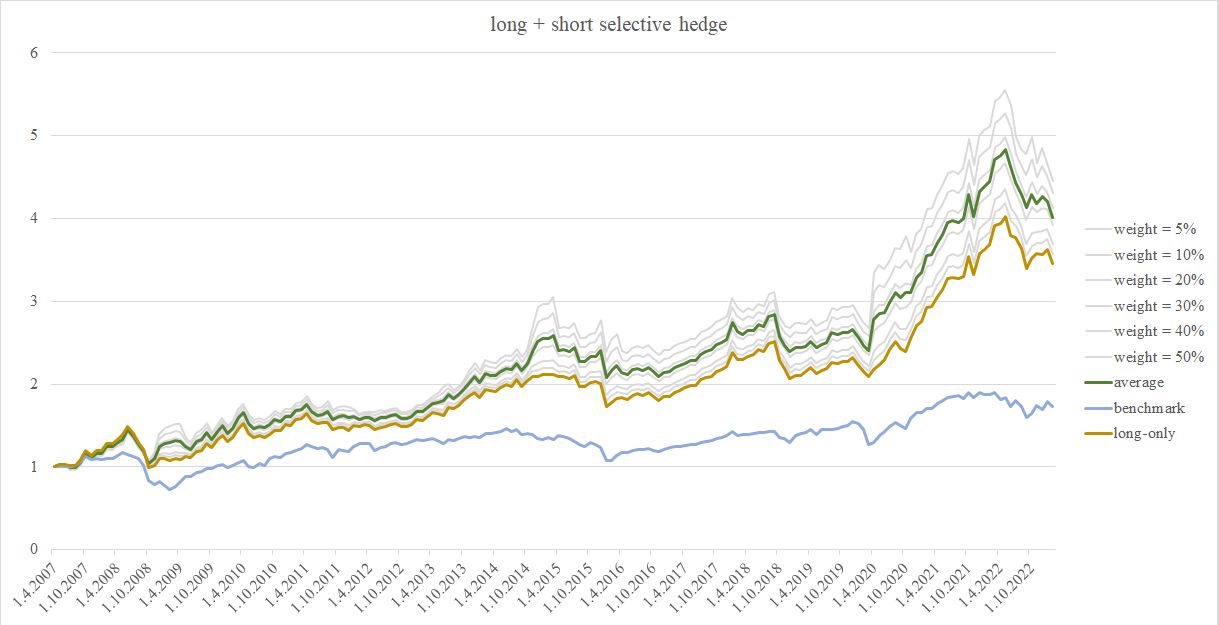

Primarily based on our earlier findings and associated literature, we develop our remaining technique by combining the lengthy leg with weighted and selectively utilized quick leg. We then in contrast its efficiency to that of the long-only momentum technique and the benchmark.

The lengthy leg makes use of the pure momentum technique, investing within the 4 top-performing ETFs based mostly on the common of three, 6, 9, and 12-month momentum rankings. As established earlier, this place supplied steady efficiency with out requiring extra filtering.

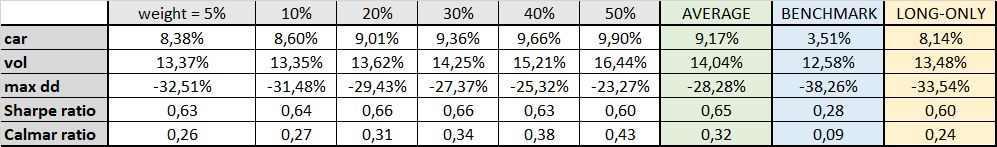

For the quick place, we opted to quick a single ETF and examined weights starting from 5% to 50%. We imagine a 30% weight presents the perfect stability, because it minimizes danger whereas successfully hedging throughout unfavorable market circumstances. Desk 10 offers an outline of efficiency metrics throughout completely different weights. Furthermore, the 30% weight aligns with prior findings and literature highlighting the advantages of decreased quick publicity.

In conclusion, the ultimate long- quick selective technique outperforms the long-only momentum technique and the benchmark, as proven in Determine 10 and Desk 10. The Sharpe and Calmar ratios are considerably greater for the long-short selective technique, indicating higher risk-adjusted returns.

Determine 10 100% lengthy momentum + variable weight of quick selective hedge

Desk 10 100% lengthy momentum + variable weight of quick selective hedge – efficiency traits

Conclusion

After our efforts to reinforce commodity and sector ETF momentum methods, we utilized the data to enhance ETF asset momentum. By combining the correlation filter—calculated because the ratio of 20-day to 250-day correlations amongst ETFs—with selective shorting, we developed a sturdy long-short technique. The ultimate technique of going lengthy on the 4 top-ranked ETFs and selectively shorting 1 ETF with a 30% weight, considerably enhances efficiency and outperforms the benchmark. Moreover, this technique surpasses long-only momentum by offering efficient hedging throughout opposed circumstances.

These key findings of our evaluation are: Conventional long-short momentum methods underperform. After separating the lengthy and quick legs, we discovered the long-only leg to be efficient, however the short-only leg required changes to enhance efficiency. The correlation filter had a minimal impression on the lengthy leg however proved extremely efficient for the quick leg, reliably figuring out intervals for selective hedging. The long-short selective hedge technique combines an extended leg with a 30% weighted quick leg, utilizing a correlation filter. The technique achieves a superior efficiency and return-to-risk ratios.

Writer: Margaréta Pauchlyová, Quant Analyst, Quantpedia

References

Beluská, Soňa and Vojtko, Radovan, Easy methods to Enhance ETF Sector Momentum * (October 11, 2024). Accessible at SSRN: https://ssrn.com/summary=4988543 or http://dx.doi.org/10.2139/ssrn.4988543

Du, Jiang and Vojtko, Radovan, Robustness Testing of Nation and Asset ETF Momentum Methods (March 25, 2023). Accessible at SSRN: https://ssrn.com/summary=4736699 or http://dx.doi.org/10.2139/ssrn.4736699

Vojtko, Radovan and Pauchlyová, Margaréta, Easy methods to Enhance Commodity Momentum Utilizing Intra-Market Correlation (September 16, 2024). Accessible at SSRN: https://ssrn.com/summary=4964417 or http://dx.doi.org/10.2139/ssrn.4964417

Are you in search of extra methods to examine? Go to our Weblog or Screener.

Do you need to study extra about Quantpedia Professional service? Verify its description, watch movies, overview reporting capabilities and go to our pricing supply.

Do you need to know extra about us? Verify how Quantpedia works and our mission.

Are you in search of historic knowledge or backtesting platforms? Verify our listing of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookDiscuss with a good friend