The entire world remembered what occurred on Tuesday, September eleventh, 2001, when 2,977 folks died within the historical past’s deadliest terrorist assault.

An American Airways Flight 11 airplane hijacked by terrorists deliberately crashed into the North Tower of the World Commerce Heart constructing (someplace between the 93rd to 99th flooring) at 8:46 AM Japanese Normal Time.

A second hijacked airplane (United Airways 175) crashed into the South Tower of the World Commerce Heart constructing between flooring 77 and 85 at 9:03 AM Japanese Normal Time.

Contents

The World Commerce Heart and the New York Inventory Change are in New York.

The occasions occurred earlier than the inventory market’s common open time at 9:30 AM Japanese Normal Time.

Subsequently, the New York Inventory Change and the Nasdaq didn’t open for regular buying and selling that Tuesday.

They usually remained closed for the rest of that week.

The markets opened once more the next Monday.

That week, when the market reopened, we noticed the SPX (S&P 500 index) drop from 1090.23 to 965.80, an 11.4% drop.

However the SPX index recovered that loss and was again to its pre-attack ranges three weeks later.

Supply: TradingView

September eleventh, 2024, was not as tragic as that date twenty-three years in the past.

Nonetheless, there was some attention-grabbing intraday market motion.

Here’s a 5-minute chart of the SPX on September eleventh, 2024…

10X Your Choices Buying and selling

The SPX opened at 5496.42 and dropped to 5406.96 – a 1.6% drop.

An 89-point drop like that may be thought of a massive transfer.

Then it did a full-reversal closing above, the place it began by over 57 factors or 1%.

It closed at 5554.14.

That is what merchants name a “whipsaw” day.

The ATR (Common True Vary) for that day was 80.

On that day, SPX went down 89 factors, after which it went again up that 89 factors to the place it began.

Then, it continued as much as one other 57 factors.

From backside to prime, it traveled 147 factors in 5 hours.

The SPX is shifting at a mean charge of 29 factors per hour. It was shifting quick.

What Does the Each day Candlestick Look Like on a Whipsaw Day?

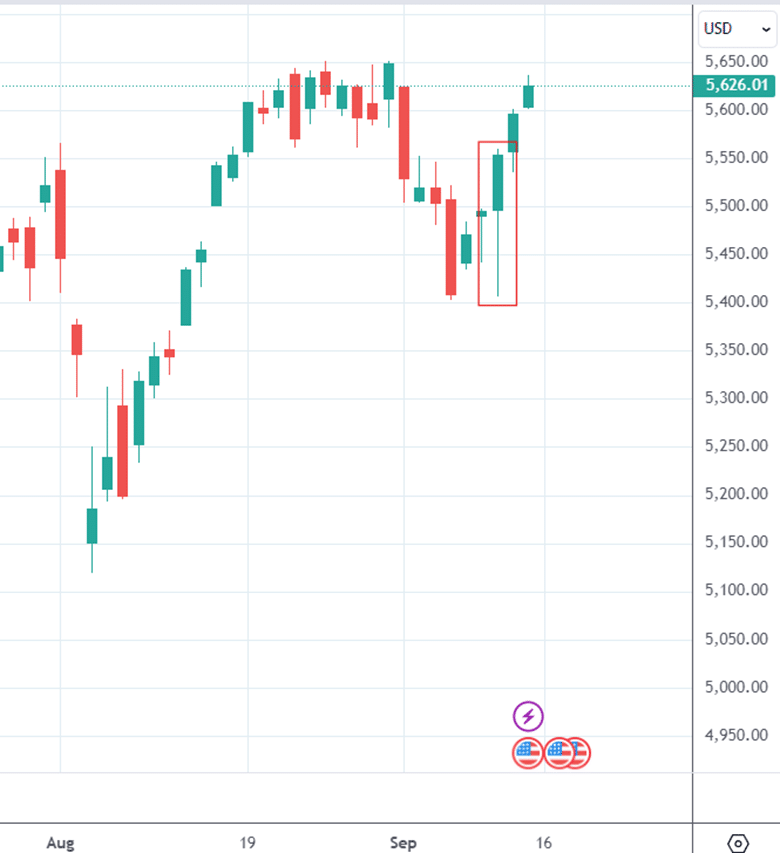

It seems like this one that’s highlighted (which is September eleventh, 2024).:

This candlestick is just not a “pin bar” as a result of a pin bar has a small physique.

It is a full-bodied up-day candle with a backside wick, a really bullish candlestick sample.

And the market did transfer greater the next two days.

How Uncommon Are Whipsaws Like That?

This candlestick form is just not notably uncommon.

Nevertheless, the magnitude of the whipsaw the place SPX went down greater than 1% after which closed up over 1% is a bit uncommon.

From the interval beginning in 1991 to September eleventh, 2024, this whipsaw prevalence of that magnitude occurs about 3% of the time.

The higher the magnitude of the whipsaw, the extra uncommon they’re.

So a whipsaw of two% down after which closing 2% up could be even rarer.

Whipsaws of the wrong way are uncommon. In different phrases, a market initially going up 1% after which closing down 1% could be rarer than if it initially went down 1% after which closed up 1%.

As an attention-grabbing facet word, whipsaws are extra frequent when VIX is greater (say above 25).

Nevertheless, on that day, VIX was not above 25. It was simply barely under 20.

How Uncommon Are Market Closures?

In the event you imply how uncommon it’s for the markets to be closed for the remainder of the week after the terrorist assault, it’s uncommon.

Prolonged market closures of such nature have occurred solely twice in historical past.

One time throughout World Struggle I and one other time through the Nice Despair.

Apart from September eleventh, it had not occurred inside our lifetime to this point – except you might be over 110 years of age to have seen World Struggle I or over 95 years to have seen the Nice Despair.

Are These Details Correct?

I perceive that some nitty gritty particulars on this article comprise obscure statistics. Solely right here are you able to get particulars equivalent to the rate of SPX shifting at a charge of 29 factors per hour

They’re believed to be correct on the time of the writing.

Being human lends the opportunity of errors. As well as, the sources from which these details are obtained is also inaccurate (as people compile them).

The place Are The Sources From Which Some Of These Details Are Obtained?

In fact, from Wikipedia, equivalent to right here and right here.

The second hyperlink might comprise photographs some viewers would reasonably not be reminded of.

As to the statistics on the prevalence of whipsaws, we’ve got to thank the analysis group at Tastylive and thank them for publishing it on YouTube.

The statistics that they did had been on SPY. Nevertheless, since SPY is the ETF of the SPX and the 2 are extremely correlated, it’s affordable to imagine that it additionally applies to SPX.

We hope you loved this text on what occurred out there on September eleventh, 2001, and 2024.

When you have any questions, please ship an e-mail or depart a remark under.

Commerce protected!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who will not be acquainted with change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.