Merchants, primarily based on the setups presenting forming for the upcoming week, I’ve divided the watchlist into two essential sections: Imply Reversion and Continuation. Whereas the general atmosphere stays exceptionally favorable for lengthy swings and continuation, similar to the commerce I mentioned intimately and walked by means of that I had in TSLA, with my Inside Entry members, there’s no denying that there are a number of shares near a possible A+ reversion alternative.

So, with many names on look ahead to the upcoming week, let’s get proper into it.

Overbought Names on Look ahead to a Reversion

For a inventory to satisfy my standards for a imply reversion/pullback alternative, a number of variables have to exist and be met. Much like what was current in SMCI earlier within the yr or extra just lately in MSTR. For instance, I wish to see the inventory over 200% prolonged from its rising 200-day, anyplace from 6 – 10 ATRs prolonged from its 50-day, consecutive gaps, vary growth, and blowoff quantity signaling exhaust. A number of names are near becoming that standards coming into the week.

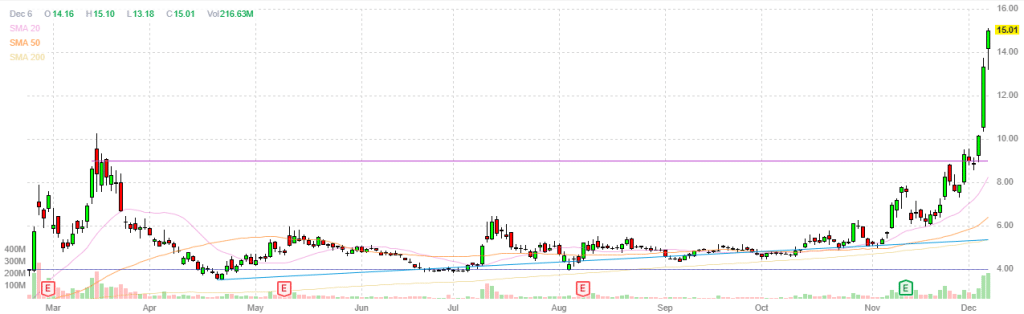

Soundhound AI (SOUN)

Former runner in the course of the earlier small-cap AI theme. It’s up impressively within the month, over 160%, with a excessive brief rate of interest and optionable as nicely. Not coming into Monday anticipating it to be a brief, nevertheless it’s starting to satisfy the standards for a possible reversion within the coming days.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Ideally, I’d prefer to see continued gaps and vary growth, together with elevated quantity, to the excessive teenagers – $20, earlier than establishing in one in all some ways for a reversion commerce. Bear in mind, having the thought is one factor, however it all is dependent upon the setup that presents itself, which is able to decide the grading I allocate it and the chance I placed on.

Sympathy inventory: BBAI

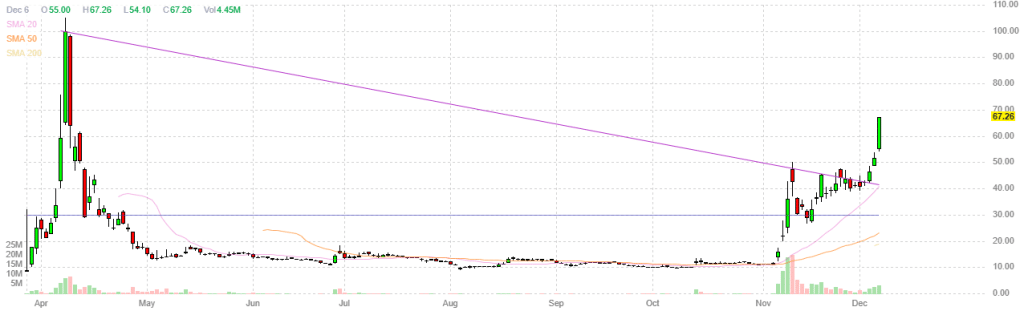

Palantir (PLTR)

Unimaginable run this quarter and YTD. Total, I’ve carried out an incredible job avoiding the title on the short-side because it prolonged to $60 and started grinding larger. Now, nevertheless, it’s beginning to lengthen with a niche and growth on Friday, RSI approaching the 80s, and uptick in quantity.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

It’s not fairly there but, however actually one to observe intently within the coming days. Ideally, this has continuation over $80, going extra vertical with additional gaps and growth. For me to get excited and focus up on the potential reversion, I’ll have to see it prolonged a number of ATRs farther from Friday’s shut, and transfer crimson with regular promoting strain and relative weak spot to its sector and general market.

Future Tech100 (DXYZ)

The fund, which holds an funding in SpaceX and just lately reported a NAV of $5.32 per share of widespread inventory, is up over 300% on the month and 600% YTD. Put up-election, after topping out close to $50 it grew to become a well-liked and well-known brief alternative, given the premium to NAV it was buying and selling.

With the inventory buying and selling at a whopping premium to its NAV, it would now be perceived by many as a ‘free-money’ brief opp, which may very well be the gas it wants to increase a lot additional than one thinks, particularly on this tape. Due to this fact, I’m fully placing my bias apart and relying utterly on worth motion earlier than trying to enter.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Ideally, this extends a number of ATRs larger and blows out cussed brief individuals, together with quantity exhaust, earlier than fading off. This concept can type in a number of totally different setups if it materializes. However on the core of them, I’ll be in search of a big character shift that features outlier quantity signaling shorts have exhausted, regular promoting strain, which could encompass the inventory being unable to reclaim intraday or multi-day VWAP / a serious help zone earlier than breaking crimson, and former days’ excessive, for instance.

Names on Look ahead to Continuation

Whereas the market continues to soften up, till the music stops, I’ll proceed to determine and react to comparatively robust names setup with favorable R: R for continuation.

Vistra (VST)

From final week’s watchlist, the title remains to be consolidating close to 52-week highs, with contracting vary and quantity. Like final week’s ideas and plan, I’m nonetheless in search of a spread breakout over $163. Importantly, I might want to see worth maintain above prior resistance and elevated RVOL to get lengthy for a multi-day swing lengthy.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Disney (DIS)

Important earnings transfer and now a gradual contraction close to its most up-to-date pivot excessive and simply over 5% away from its 52-week highs. If DIS can break above $117 and type an uptrend above its VWAP intraday, I’ll look to provoke a protracted versus the LOD, focusing on a 1 ATR transfer towards $120 to take earnings and start trailing my place.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

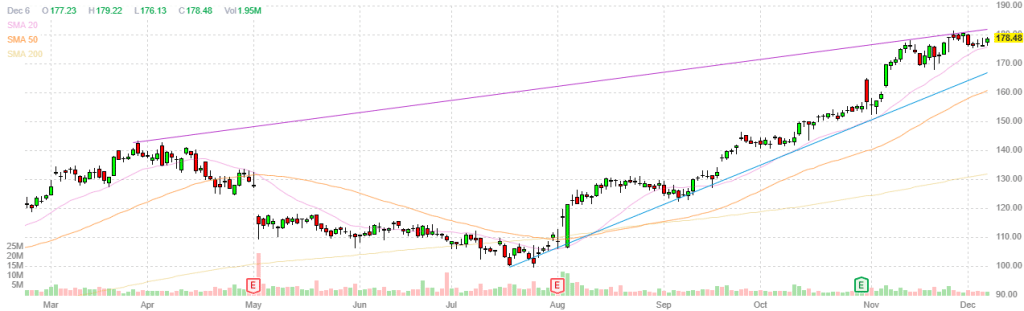

DoorDash (DASH)

Consolidating close to 52-week highs and the $180 breakout degree. If the inventory can push above $180 and maintain on to a breakout in quantity, I’ll provoke a protracted versus the LOD initially and path the cease close to the $180 key space as soon as the inventory trades half an ATR above the $180 degree. I plan on reducing the place because it extends a full ATR above $180, and from there, my cease will probably be trailed by 1 ATR to the present worth, focusing on a transfer nearer to the excessive $180s.

*Please notice that the costs and different statistics on this web page are hypothetical, and don’t mirror the affect, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Necessary Disclosures