The chemical manufacturing business stands as a big contributor to international carbon emissions, producing greater than 2B metric tons of carbon dioxide yearly. This environmental impression stems from each the uncooked supplies required and the emissions produced throughout manufacturing processes. The business has lengthy grappled with these emissions, as many have confirmed proof against conventional seize, avoidance, or discount strategies. Turnover Labs has developed an electrolysis know-how that not solely addresses emissions captured but additionally transforms these byproducts into precious chemical constructing blocks, which might be repurposed for industrial functions together with plastic manufacturing and gas manufacturing. The corporate’s proprietary electrolyzers, that are strategically deployed at manufacturing services and seamlessly built-in with current infrastructure. This on-site implementation permits direct assortment of producing emissions whereas concurrently producing syngas, a important precursor for petrochemical manufacturing. By means of this dual-function strategy, Turnover Labs successfully decarbonizes chemical manufacturing operations throughout each upstream and downstream processes. Except for the environmental advantages, Turnover Labs’ round system delivers vital financial benefits. The answer streamlines operations by lowering a number of value facilities, together with upkeep necessities, transportation wants, purification processes, infrastructure investments, storage services, and monitoring methods.

AlleyWatch caught up with Turnover Labs Founder and CEO Marissa Beatty, PhD to be taught extra in regards to the inspiration for the enterprise, the corporate’s strategic plans, latest spherical of funding, and far, way more…

Who have been your buyers and the way a lot did you increase?

Turnover Labs simply had our pre-seed spherical, which was co-led by Tempo Ventures and GC Ventures for $1.4M.

Inform us in regards to the services or products that Turnover Labs affords.

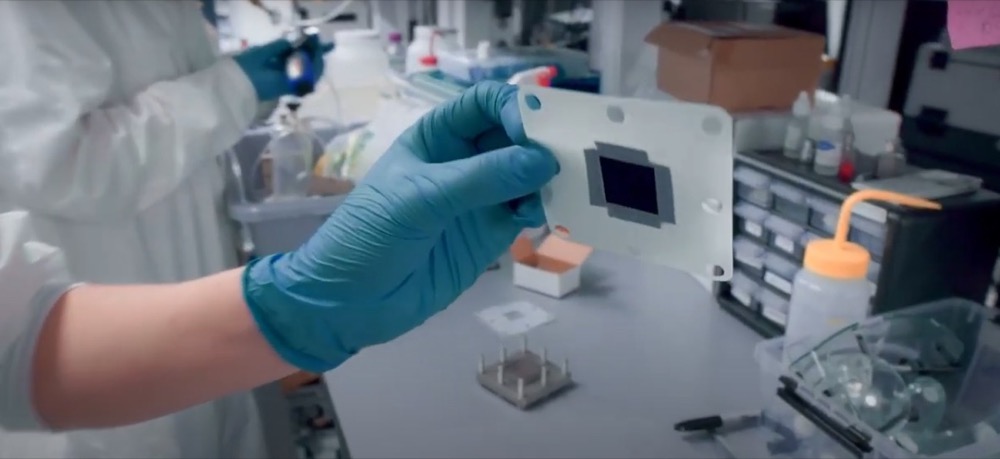

Turnover is growing next-gen ultra-durable electrolyzers for the chemical compounds business. Our methods can rework soiled CO2 emissions into precious chemical compounds, corresponding to these utilized in making plastics, solvents, fuels, and extra. We’re immediately integrating into current services, enabling them to show their waste streams into income.

What impressed the beginning of Turnover Labs?

I fell in love with this know-how throughout my PhD and needed to proceed working with it. It has an enormous potential, and the easiest way to get it into business arms is to do it your self. The tutorial analysis was an incredible basis for the know-how, however to see real-world use, our present growth is concentrated on sensible features which matter to business, corresponding to sturdiness, scalability, and financial feasibility.

How is Turnover Labs completely different?

In relation to sustainable chemistry, our basic strategy is to leverage current infrastructure fairly than constructing one thing from scratch. This implies we work immediately with business incumbents, which undoubtedly has its personal challenges, however has the benefit of rapid entry to huge scale. As a substitute of getting to construct a complete facility or pipeline from the bottom up – we are able to construct immediately for current wants. This industrial focus has revealed the significance of system sturdiness, which is the first metric we purpose to optimize.

What market does Turnover Labs goal and the way large is it?

We goal the petrochemicals business, which is an enormous $425B market. In that business, we’re seeking to make the fundamental feeds for a lot of fundamental merchandise corresponding to plastics, solvents, fuels, and extra.

What’s your corporation mannequin?

We’re doing on-site deployment of our know-how, as a result of our methods are sturdy and adaptive to a number of wants of various services. On-site deployment enormously reduces the price of transmission or storage of emissions, which makes our product simple to combine for firms seeking to scale back their carbon footprint with out breaking the financial institution.

How are you getting ready for a possible financial slowdown?

By elevating cash now!

In all honesty, our financial fashions are deliberately agnostic to authorities subsidies. They’re a boon if and once we can make the most of them, however we purpose to offer worth to firms whatever the political or financial context. As an example, by producing chemical compounds on-site, we decouple from transportation prices, which might be extremely unstable. With extra steady pricing, prospects can extra confidently forecast future prices, and function with greater margin.

What was the funding course of like?

Intense for a first-timer. Coming from an educational background, it’s daunting to lift cash, however we discovered allies in buyers that shared our views, and believed in our mission. Getting recognition from organizations corresponding to Forbes 30 Beneath 30, the Activate Fellowship, and CleanTech Open has been unimaginable, and has helped present quite a lot of connections.

What are the most important challenges that you just confronted whereas elevating capital?

Our work is on the technological leading edge, so precisely conveying the applying of the know-how might be troublesome.

What components about your corporation led your buyers to jot down the verify?

Sustainable chemical compounds is turning into a preferred area – I believe we stand out as a result of we’re constructing a really capital environment friendly mannequin that works for our prospects. Having the ability to ship worth at each giant and small scales helps us not fall right into a scaling lure. Above all, our buyers are effectively acquainted with the issue we’re fixing, and are capable of see the unimaginable potential it has.

What are the milestones you propose to attain within the subsequent six months?

Our price proposition comes from our system sturdiness – so for the subsequent 6 months we’re working our know-how by way of the gauntlet of various actual life emissions samples to get sturdiness as excessive as potential.

What recommendation are you able to supply firms in New York that would not have a recent injection of capital within the financial institution?

New York has many assets that aren’t seen in plain sight – join with different founders or firms at your stage, and don’t be afraid to ask questions!

The place do you see the corporate going within the close to time period?

We’re on the lookout for early pilot alternatives and locations to vet our tech in actual world contexts.

What’s your favourite fall vacation spot in and across the metropolis?

Final fall I went as much as the Finger Lakes and it was an incredible journey – superb foliage and hikes. However my favourite vacation spot throughout the metropolis may be the bar Mace!